NFT’s and their impact on the luxury watch market

NFT’s have taken 2021 by storm. Like any new thing, there’s a lot of confusion surrounding what it is, what it does, and why it matters. Is it just a fad? Do they matter at all? How are NFT’s even cool? These are all totally legitimate and common questions, ones I hope to address in this article. The long and short is, NFT’s could be spectacular for the watch industry and watch community, but to get there, the industry will have to retool how it thinks about the technology and its value. More than anything with this article, I want to push the industry to think more creatively about what types of NFT’s might create hits in the watch community. Before we get into that, let’s just cover the basics.

Non-fungible tokens ... what … why?

Non-fungible token, NFT, isn’t exactly overly attractive when spelled out in full. This new “thing” represents a unit of data stored on a digital ledger, often the Ethereum blockchain, that certifies a digital asset to be unique and therefore not interchangeable. What we mean by not interchangeable is that unlike other fungible tokens (Bitcoin or Ether) or traditional fungible assets (gold) where units are indistinguishable from one another, non-fungible tokens authenticate and track unique digital assets. All of this is ultimately to facilitate the trade of digital “unique pieces.”

Conceptually, we can think of the rise of NFTs as private ownership over traditional items (homes, paintings, furniture, watches) spreading into the digital world. With NFTs, it is possible to claim and prove ownership over the digital (images, videos). Of late, this has proved popular for what we might call “digital native” items - video highlights from NBA games, the first tweet by Jack Dorsey, Rick & Morty digital artwork by the show’s creator. So why do this at all? Why not, as many critics have questions, simply screenshot a tweet or video record an NBA highlight? Without diving too deeply in economic theory, the answer is simple: private ownership and provable authenticity create the structure of markets, your screenshot or recording does not.

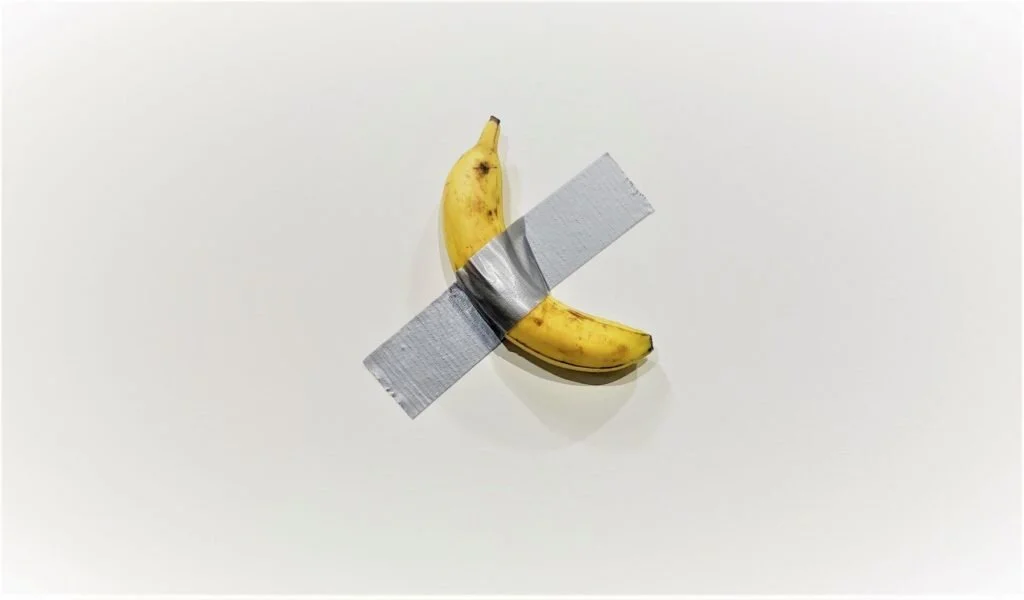

We can observe the relationship between markets, authenticity, and value mostly clearly in art. Anyone could duct tape a banana onto the wall, but not everyone can fetch $120,000 for doing so. Paying $120,000 for a duct taped banana buys the art collector the authenticity, the provenance of the artwork. As with NFT’s, your screenshot of a tweet might match the NFT equivalent of an auctioned tweet in theory. Without the provenance though, the proof of uniqueness and authenticity, it’s devoid of value in practice. It’s important to remember that this is by no means particular to “bizarre” assets such as duct tape banana art or owning video highlights. Ownership and authenticity lubes the real estate and automobile markets with deeds of sale, or the watch industry leverages box and papers as the guarantor of authenticity and value.

Maurizio Cattelan's Comedian, for sale from Perrotin at Art Basel Miami Beach. Photo by Sarah Cascone.

How’s the watch industry getting into the action?

Things are just getting underway in the watch industry with NFTs. We can see that Jean Claude Biver recently pushed to auction the first ever NFT on OpenSea, the “Sothebys” of NFTs. The NFT was a “digital twin,” an image of an early prototype Hublot Big Bang. The close of the auction was supposed to occur on April 30th, but it’s not entirely clear what the outcome was - the high bidder canceled a 25 ETH bid (circa $70,000) on the final day of the auction. There are more in the pipeline though, and it’s not only big brands hopping onboard.

Jean-Claude Biver symbolically chose the famous Bigger Bang All Black Tourbillon Chronograph "Special piece"

Indies are also jumping onboard this month - Konstantin Chaykin is auctioning digital twin NFTs for each time-indicating variation of his infamous Joker watch.

Konstantin Chaykin And The Worlds First NFT-Joker Watch (Konstantin Chaykin)

Now if paying $60,000+ for the “digital twin” of a physical timepiece feels lackluster, that’s because it is. Our estimate is, digital twin NFTs are unlikely to spur much excitement from the watch community. It might have “investment potential,” but diehard enthusiasts of horology aren’t going to flock to this form of NFT like diehard NBA fans flock to the highlight NFTs.

Of course, this doesn’t mean that the watch industry should stop using NFTs in their entirety. And in the case of Biver’s NFT, we can see that things have the potential to move in the right direction. The first watch NFT was, at the least, an unusual timepiece (a prototype), otherwise not seen frequently on Instagram. There is pent up demand for the rare and unusual, since the watch community is drowning in common watch images on Instagram. We’ve acclimated to social media to such an extent that spectacular watches have increasingly become wallpaper, as we subconsciously scroll and scroll.

To get the most out of NFTs though, the industry needs to move beyond 1-to-1 thinking here. And it could come from moving toward NFTs for “digital native” memorabilia.

Toward “digital native” memorabilia

NBA fandom isn’t (yet) chasing NFT digital twins of game balls. Probably because forcing the physical through the digital can feel a little too literal. The Top Shop is much better served by selling NFTs that digital native, meaning things that were produced specifically with the internet as the intended medium. That’s why ownership over a video clip, the quintessence of our online content consumption on YouTube, Facebook, and even Instagram, makes a lot of sense.

The watch industry would benefit greatly in the NFT marketplace by offering digital native memorabilia. This could include micro, digitized portions of a brand’s archive (a design sketch, unseen photo, or even notes on the timepiece from the timepiece’s creators). This would produce a marketplace around the fandom of the brands, the timepieces, and their histories in ways that would be much healthier than buying and selling wrist pics.

There are ideas about NFT technology, blockchain technology broadly, being used as a tool for authentication of luxury timepieces as well. Bridging the gap between digital and physical is still no simple task. Big players in other industries are experimenting with the technology though, as we’ve seen Nike recently patent a solution for the authentication of its sneakers (for those not in the know, sneakers have become big money and knock-offs abound).

If NFTs are merely stuck as the digital twin of physical timepieces, then it’s highly probable that this will move through a typical bubble and bust cycle, or not really get off the ground at all. In a marketplace trading essentially ubiquitous images found on Instagram, there simply won’t be anything to hold onto other than “value.” If the industry can use NFTs as a means of promoting and supporting a new marketplace for broader horological memorabilia, then things might move in another direction, one where the culture of the community and the type of collected items run deep, promoting the knowledge of horological history. We’re going to have to keep our fingers crossed while we wait and see.